At every stage of our research, we collaborate with community organizations, policy advocates, and policymakers.

Crossing the Border for College: Documenting the Experiences of Binational Students

Supported by the University of California Alianza MX, and in partnership with the Center for Research + Evaluation at UC San Diego and the Autonomous University of Baja California (UABC), this project examines Mexican students participating in California’s AB 91 pilot program, which allows eligible low-income students living near the U.S.-Mexico border to pay in-state tuition at select California community colleges. The research documents students’ educational pathways, career goals, and lived experiences while identifying opportunities to strengthen binational higher-education systems in the border region. The project also includes the production of an ethnographic film in collaboration with UC Television and a public event showcasing participant-created media.

Organizational Resilience in the Face of the Anti-DEI Movement

We are interviewing faculty across all types of US postsecondary institutions who are trying to improve the conditions, experiences, and outcomes of racially marginalized people on campus. The project is supported by the Sloan Foundation, Lumina Foundation, and Spencer Foundation. Anonymity will be assured. Please contact Laura Hamilton (lhamilton2@ucmerced.edu) for more details.

The Racial Wealth Gap and Student Loan Debt

Our research dispelled myths that most borrowers are well off, showing that Black and low-wealth households carry disproportionate shares of student debt. This research was cited by Senator Warren and others in advocating for the Biden executive action to increase debt cancellation from $10,000 to $20,000 for former Pell recipients. Further research asks if Black and low-wealth debt burdens could be reduced through changes to financial aid formulas.

KEY FINDINGS

Student debt cancellation is not “regressive.” We refute this myth and show that Black and low-income borrowers stand to gain the most from cancellation plans.

Addressing the Black student debt crisis requires a corrective history, systematic analysis, and theoretical explanation grounded in racial capitalism.

The federal government, not student borrowers should ask for forgiveness.

Wall Street Pressures in Higher Education and Beyond

We have shown that private equity-owned for-profit colleges and online degree subcontractors disproportionately enroll marginalized students and have poor graduation and loan repayment outcomes. This research has been extensively cited in Congressional hearings and Department of Education rulemaking that led to the cancellation of $21 billion in for-profit college student debt and consumer protections for for-profit and online degree programs. In partnership with the Roosevelt Institute and Berkeley Economyand Society Initiative, we plan to expand our research on private equity to other important sectors like healthcare.

KEY FINDINGS

Online education is a form of “predatory inclusion.” It targets Black and low-income students but leads to lower graduation rates and worse repayment outcomes—even in non-profits.

Public university contracts with for-profit online program managers financed by private equity or venture capital are more likely to include features associated with predatory inclusion.

Private equity buyouts in higher education result in higher tuition and per-student debt.

Multi-brand organizational structures allow for-profit colleges to provide substandard products, while evading legal action and reputational penalties.

Administrative Burdens in Financial Aid and Debt Relief Programs

We uncovered punitive administrative burdens in financial aid programs that led more than 300,000 California students to incur debts when they left school during COVID, likely because of health and economic hardships. Following this research, the California Coalition for Borrower Rights and Assemblymember Blanca Pacheco introduced Assembly Bill 1160 Protecting Students from Creditor Colleges Act to remove re-enrollment barriers for these students. Similarly, we provided the most robust evidence to date that administrative burdens disproportionately prevent low-income and Black borrowers from receiving debt relief under income-driven repayment programs.

KEY FINDINGS

College students in the state of California accrued around $390 million in student debts to their institutions during the 2020-2021 and 2021-2022 academic years.

Income-driven student repayment programs are hindered by administrative burdens that impede borrowers in lower-income and higher-percentage-Black census blocks from seeking relief.

Racialized Equity Labor in White Spaces

We coined the term “racialized equity labor” to describe the often-uncompensated efforts of people of color to address systemic racism and racial marginalization within postsecondary spaces characterized by white leadership, a white student body, and/or practices of historically white research universities. Our work documents the efforts of student activists, staff, and faculty to change their campuses and resist watered down university initiatives centering individual difference in favor of collective social action.

KEY FINDINGS

Student activists of color labor to make their campuses safe and comfortable for historically underrepresented populations—but do so at a personal cost.

The nature and intensity of racialized equity labor undertaken by university employees depends on organizational logics of “diversity” vs. “equity.”

Public defunding undermines cultural programming for racially marginalized students, ultimately outsourcing labor to students and employees of color.

Watch as Postdoctoral Fellow Dr. Caleb Dawson discusses (un)free labor and the costs of service work in the university.

Upcoming Projects

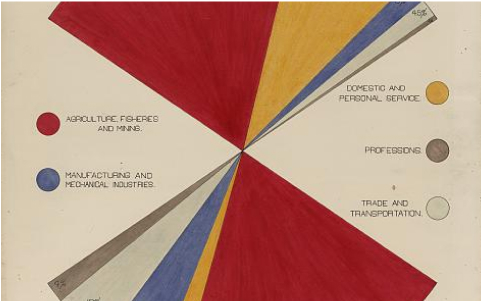

Coming Soon: Du Bois, Data Visualization Innovations, and Underrepresented Student Belonging in STEM

In partnership with Fisk University and Princeton University, we have received $2 million in funding from the National Science Foundation to study if the centering of underrepresented innovators in STEM curriculum may increase a sense of belonging and educational persistence by underrepresented students. We will test this thesis by developing a 1-week lesson plan module for STEM research methods courses. The lesson plan will teach STEM students about statistical and data visualization innovations by Black social scientist W.E.B. Du Bois and his diverse collaborators.

Lab Research Publications

A Supplemental Wealth-Based Pell Grant

How to Meet Unaddressed Need and Close Racial Gaps in Student Loan Borrowing

2024

Racialized Horizontal Stratification in US Higher Education: Politics, Process, and Consequences

2024

Administrative Burden in Federal Student Loan Repayment, and Socially Stratified Access to Income-Driven Repayment Plans

2023

Asymmetry by Design? Identity Obfuscation, Reputational Pressure and Consumer Predation in U.S. For-Profit Higher Education

2021

When Investor Incentives and Consumer Interests Diverge: Private Equity in Higher Education

2020